Download Nautilus Minerals press release

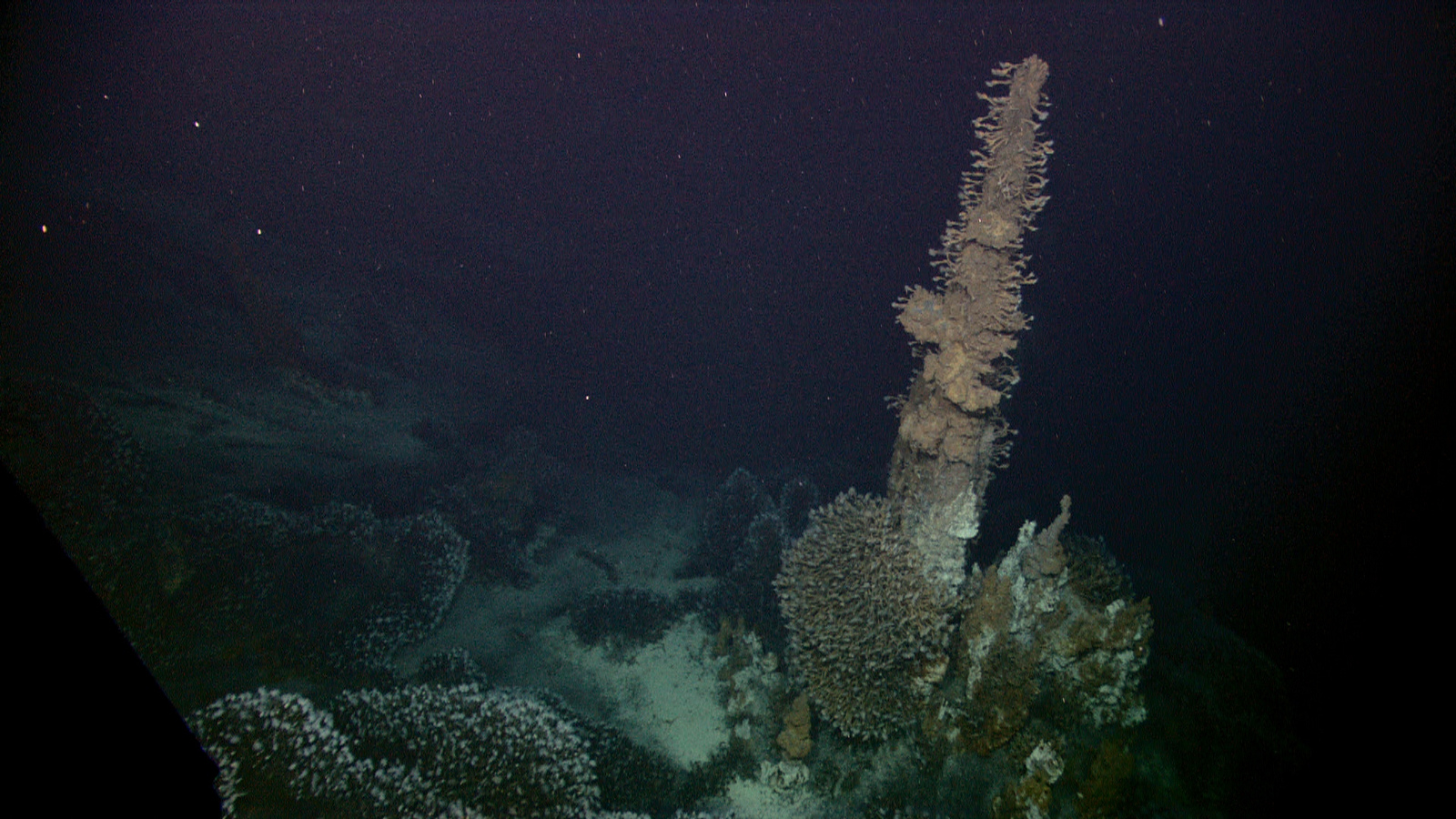

TORONTO, ONTARIO Oct. 11, 2017 — Nautilus Minerals Inc. (TSX:NUS) (OTC:NUSMF) (the “Company” or “Nautilus“) announces that it has entered into a Funding Mandate Agreement (the “Agreement“) with Deep Sea Mining Finance Ltd. (“DSMF“) pursuant to which DSMF will seek to leverage the international expertise and financial relationships of Nautilus’ two major shareholders to assist in advancing the development of the Company’s Solwara 1 Project.

As previously disclosed, Mark P. M. Horn will lead DSMF, which is a newly incorporated private company in the British Virgin Islands and intended to be 50% owned by each of: (i) USM Finance Ltd, a wholly-owned subsidiary of USM Holdings Ltd, an affiliate of Metalloinvest Holding (Cyprus) Limited (“Metallo“); and (ii) Mawarid Offshore Mining Ltd. (“Mawarid“), a wholly-owned subsidiary of MB Holding Company LLC.

DSMF has been appointed as the Company’s exclusive financial advisor in respect of the remaining project financing of up to US$350 million to complete the development of the Solwara 1 Project.

The Company may terminate DSMF’s exclusivity rights under the Agreement if DSMF fails to arrange binding commitments in respect of financings of at least US$50,000,000 (the “Interim Financing”) by December 4, 2017.

The Company will pay the following to DSMF:

- an initial retainer fee of US$75,000 upon DSMF securing the Interim Financing, and an additional fee of US$30,000 to be made following the initial six month period in advance of each three month period during the term of the Agreement (collectively, the “Retainer Fees“).

- subject to DSMF securing the Interim Financing, the Company will make a lump sum payment of US$350,000 as reimbursement for costs and expenses of DSMF incurred in connection with the Interim Financing (the “Expense Reimbursement“), and the Company will reimburse DSMF for all of its reasonable costs and expenses which may be incurred in connection with subsequent financings.

- a cash fee on the aggregate consideration received by the Company in a funding transaction equal to 6% in respect of equity financings, or 5% in respect of any debt financing, trade financing or other form of funding transaction during the term of the Agreement, and for a period of twelve months following its cancellation in respect of investors introduced to the Company by DSMF (the “Finder Fees“). No fees will be payable in respect of any funds provided by DSMF or its affiliates (including Metallo and Mawarid).

- a cash fee equal to 1.0% of the amount raised by the Company in a funding transaction arising from an unsolicited investment proposal received from a third party pursuant to the terms of the Agreement (together with the Finder Fees, the “Financing Fees“).

DSMF will have a right of first refusal in respect of matching any unsolicited investment proposals.

The Agreement will remain in effect until the earlier of January 1, 2019, or until terminated by: (a) mutual agreement; (b) the termination of DSMF’s exclusivity rights pursuant to the Agreement; (c) automatically upon the closing of funding transactions of US$350 million; or (d) upon a sale of the Company.

As DSMF will be controlled by two insiders of the Company, DSMF is a “related party” of the Company and the transactions contemplated by the Agreement constitute a “related party transaction” of the Company under MI 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101“).

The independent committee of directors of the Company, consisting of Russell Debney, determined that entering into the Agreement was exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 in reliance on the exemptions set forth in sections 5.5(a) and 5.7(1)(a) of MI 61-101, on the basis that, at the time the transaction was agreed to, neither the fair market value of the subject matter of, nor the fair market value of the consideration for, the Agreement including the Retainer Fees and the Expense Reimbursement (but excluding the Financing Fees), exceed 25% of the Company’s market capitalization.

Payment of Financing Fees by the Company to DSMF will remain subject to receipt of all necessary shareholder approvals in compliance with the requirements of MI 61-101 and/or TSX rules in the context of a specific future financing transaction which may trigger the requirement to pay Financing Fees pursuant to the Agreement.

A copy of the Agreement will be available under the Company’s profile on the SEDAR website (www.sedar.com).

The Agreement remains subject to receipt of all necessary approvals from the TSX.

The Company requires significant additional funding in order to complete the build and deployment of the seafloor production system to be utilized at the Solwara 1 Project by the Company and its joint venture partner (as to 15%), the Independent State of Papua New Guinea’s nominee.

There can be no assurances that the Company will be successful in securing the necessary additional financing transactions within the required time or at all, including in connection with the Agreement. Failure to secure the necessary financing may result in the Company undergoing various transactions including, without limitation, asset sales, joint ventures and capital restructurings.

Termination of the 2016 Bridge Financing Agreement

In conjunction with entering into the Agreement, the Company, Metallo and Mawarid entered into an agreement to terminate the subscription agreement among the Company, Metallo and Mawarid dated August 21, 2016, as amended (the “Bridge Financing Agreement“). As a result, no further amounts may be drawn by the Company under the Bridge Financing Agreement. The Company issued a total of 78,247,462 common shares for gross proceeds of US$12,000,000 under the Bridge Financing Agreement.

For inquiries relating to the Interim Financing please contact:

| Mark P. M. Horn | Hussein Al Tamimi | Inessa Krasnokutskaya | Michael Joyner | Noreen Dillane | ||||||||

| (UK) | (Middle East) | (Europe) | (North America) | (Australia) | ||||||||

| Tel:+44 7886 776 234 Email: rel=”nofollow” target=”_blank”>mark@horn.co.uk |

Tel:+ 971 4 709 1901 | Tel:+35 725 206 000 Email: rel=”nofollow” target=”_blank”>inessak@usm-group.com |

Tel:+1 416 551 1100 Email: rel=”nofollow” target=”_blank”>investor@nautilusminerals.com |

Tel:+61 7 3318 5552 Email: rel=”nofollow” target=”_blank”>investor@nautilusminerals.com |

For other information please refer to www.nautilusminerals.com or contact:

| Investor Relations Nautilus Minerals Inc. (Toronto) Email: investor@nautilusminerals.com Tel: +1 416 551 1100 |

Links:

http://www.nautilusminerals.com/irm/PDF/1924_0/Nautilusprovidescorporateupdate

http://www.nautilusminerals.com/irm/PDF/1925_0/NautilusMineralsResignationofMarkPMHornasaDirector